Your credit score is one of the most important factors in determining your eligibility for an online Personal Loan or any other credit product. A credit score represents any individual’s creditworthiness since it is calculated using your credit history which contains information such as the number of debts taken by you, your past repayment behavior, etc.

Lenders don’t like to offer online personal loans or credit cards to people with poor credit scores because they simply don’t trust them with their money. Even if you get a loan or credit card despite having a poor credit score, your loan amount or credit limit will be low, or you might have to pay a higher rate of interest. So, if your credit score is poor, make sure you improve your credit score before you apply for a loan to avoid loan rejection.

In this article, we will discuss what is considered a good credit score and how can you improve your poor credit score:

What is a Good Credit Score?

In India, credit scores are assigned by one of the top 4 credit bureaus: Experian, CIBIl, Equifax, and CRIF Hi Mark.

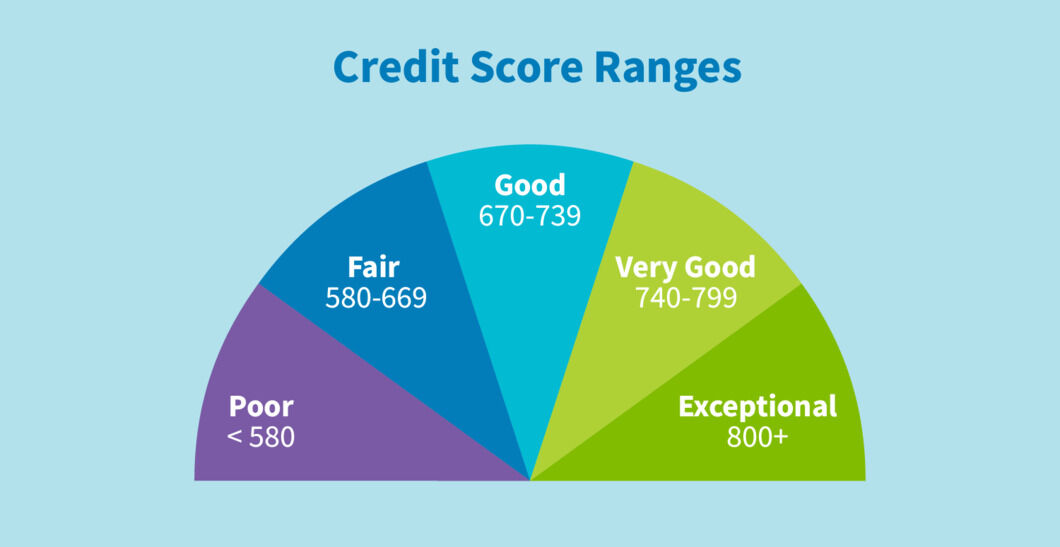

A credit score ranges between 300 and 900. According to the credit information company, the closer your credit score is to 900, the higher the chances of your loan application getting approved. Usually, a credit score of 750 & above is considered a good credit score. It yields plenty of benefits to the borrower, including attractive interest rates, fast approval, higher loan amount, etc.

How Can You Boost Your Credit Score?

There are many methods you can follow to boost your credit score. Some of them are as follows:

- Check Your Credit Report

Credit bureaus primarily calculate your credit score based on the information included in your credit report. Any incorrect information mentioned in your credit report, either due to clerical errors by lenders or fraudulent credit transactions in the borrower’s name can take a toll on the credit score. That is why you must review your credit report at periodical intervals to find out such incorrect information. And if you find any errors in your report, you must rectify them immediately to improve your credit score.

- Pay Your EMIs & Credit Card Bills on Time

One of the best practices that you can follow to boost your credit score is to pay your debts on time and in full. This is because your payment history makes up a significant part of your overall credit score. So, it is important to avoid late payments. And if you find it difficult to remember payment due dates, you can consider using automatic payments for your account or setting up a payment alert so that you can always pay your debts on time. You must check personal loan amount eligibility before applying for loan.

- Keep Your Credit Utilization Ratio Low

Credit utilization is another important factor that lenders take into consideration while calculating your credit score. The amount of credit that is available to you versus the amount you are utilizing shows your dependency on credit money. It is suggested that people should keep their credit utilization ratio at or below 30% to maintain a good credit score. In addition to reducing your credit card spending, you can lower your credit utilization ratio by asking your lender for a credit limit increase on your credit card or overdrafts. A higher credit limit will increase your credit score provided you do not end up increasing your credit card spending proportionately.

- Avoid Multiple Credit Applications

At times, you may end up applying for multiple loans or credit cards in the hope of fetching a good option. But it can work against your credit score. Every time, you apply for credit card or a retail loan, a hard inquiry is raised by the lending institution. Hence, multiple hard inquiries will significantly impact your credit score negatively. Also, if your credit application gets rejected, lenders will not be comfortable lending you a loan or credit in the future. Therefore, you should avoid applying for multiple loans or credit cards to maintain a good credit score.

Also Read: Why It’s a Good Idea to Get a Personal Loan for Travel ?

Final Words

A good credit score comes with responsible credit behavior. By following the above-mentioned tips, you can boost your credit score significantly. Once you improve your credit score, you can apply for an online Personal Loan as the Personal Loan procedure is simple and easy to follow.